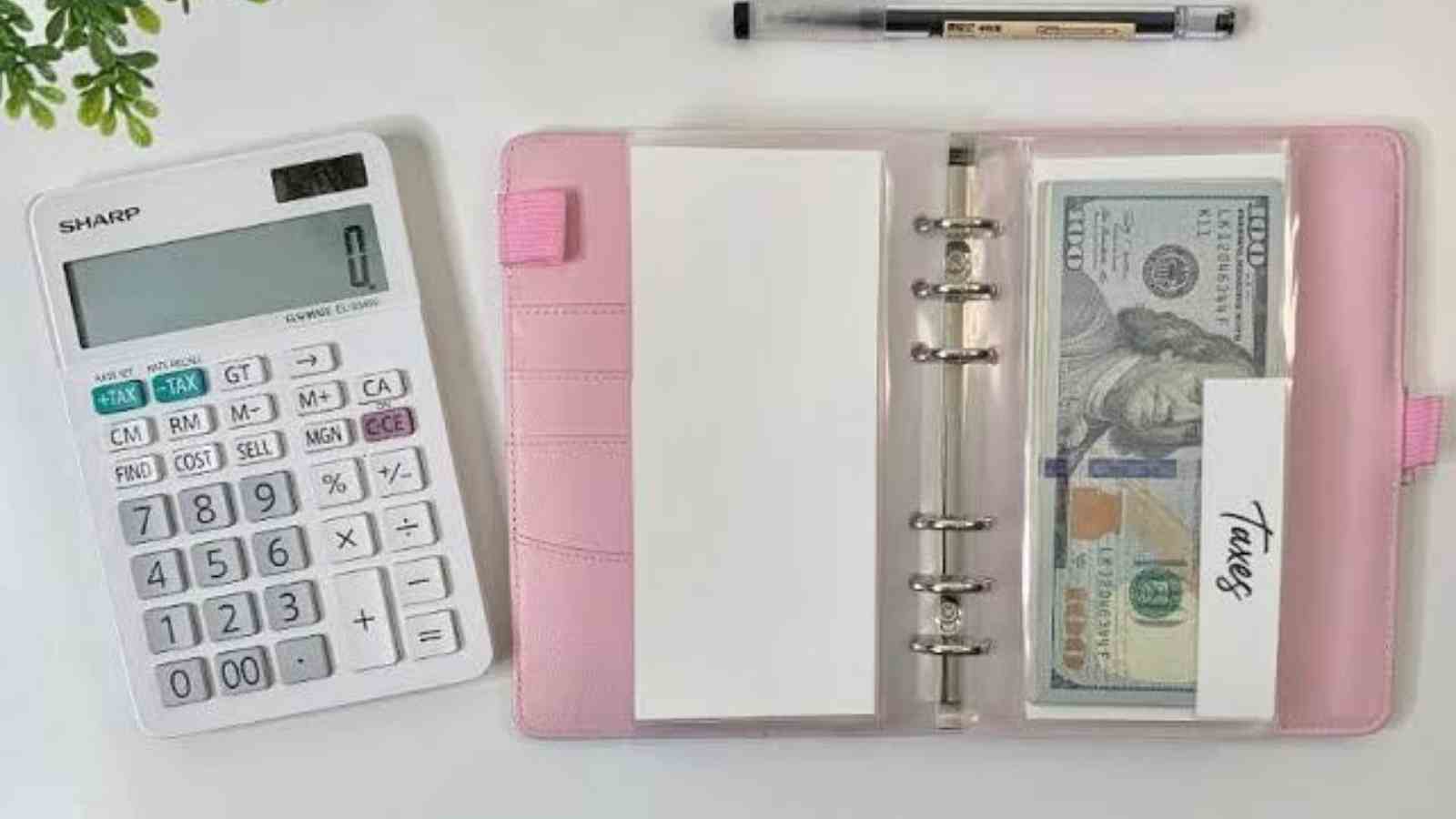

‘Cash Stuffing’ is witnessing a rise in trend as the question of how one saves money has become a cause of concern owing to the current economic situation of the United States. It is the rawest and a non-tech based way of budgeting and saving up money.

The process has its pros and cons, but the rising trend of this technique shows that the younger generation is concerned about its money, too.

Read More: 1961 Goldsboro B-52 Crash: When USA Almost Nuked North Carolina

Cash Stuffing Is An Old Technique Witnessing Its Comeback After Ages

Cash stuffing in the easiest terms means organising cash into separate envelops according to different labels and different needs. For instance, dividing money for groceries, gas, shopping, etc. This has been one of the creative alternatives of budgeting adopted by the younger generation to face the rising inflation.

A Texas resident named Jasmine Taylor, also became a part of the ‘Cash Stuffing,’ trend and she started posting on TikTok and teaching people a new way of budgeting. “I started sharing it and it just took off,” said Taylor.

She has been employing the method of cash stuffing since her 30th birthday. “I personally use what I call a zero-based budget, so whatever I get paid, every single dollar I make I give it a place,” explained Taylor. Her views on TikTok have found a tremendous reach. “I think more people are attracted to it because so many people just aren’t financially literate, so just having a straightforward method of budgeting in the times we’re currently living in…is just so much more appealing to people,” added Taylor.

What Do Financial Experts Say About The New Cash Trend?

The financial experts have conveyed that the rising popularity of cash stuffing is a direct impact of the current economic times. Stewart Fields, Managing Partner at OpenAir advisers, sees a lot of advantages of cash stuffing. “People are feeling the squeeze, they are feeling the pressure, they are seeing their savings dwindle and they are looking for any habits to get better. The biggest benefits is not using your credit cards and not going into further debt or to reduce the debt that you already carry,” he commented.

Rob Wilson, a CMU graduate and personal finance expert, applauded the new trend. He said, “I was actually happy to see someone implementing a way to be very intentional about the money that they wanted to save for the future.”

However, with benefits, also come certain criticisms and disadvantages. As Fields explained, “Cash can be lost, it can be stolen many home owner insurance policies, many renter insurance policies don’t cover lost cash and if they do, it’s very minimal.” Along similar lines, Robert too commented, “I have to say that I’m not necessarily a fan of having all this cash around and putting it in different envelopes. Anytime you have cash sitting underneath your mattress or around the house somewhere. The danger is that somebody could walk away with it and so it is definitely not the most secure way to keep your hard-earned money.”

Read More: What Is The “GentleMinions” Trend Which Has Taken Over The TikTok?