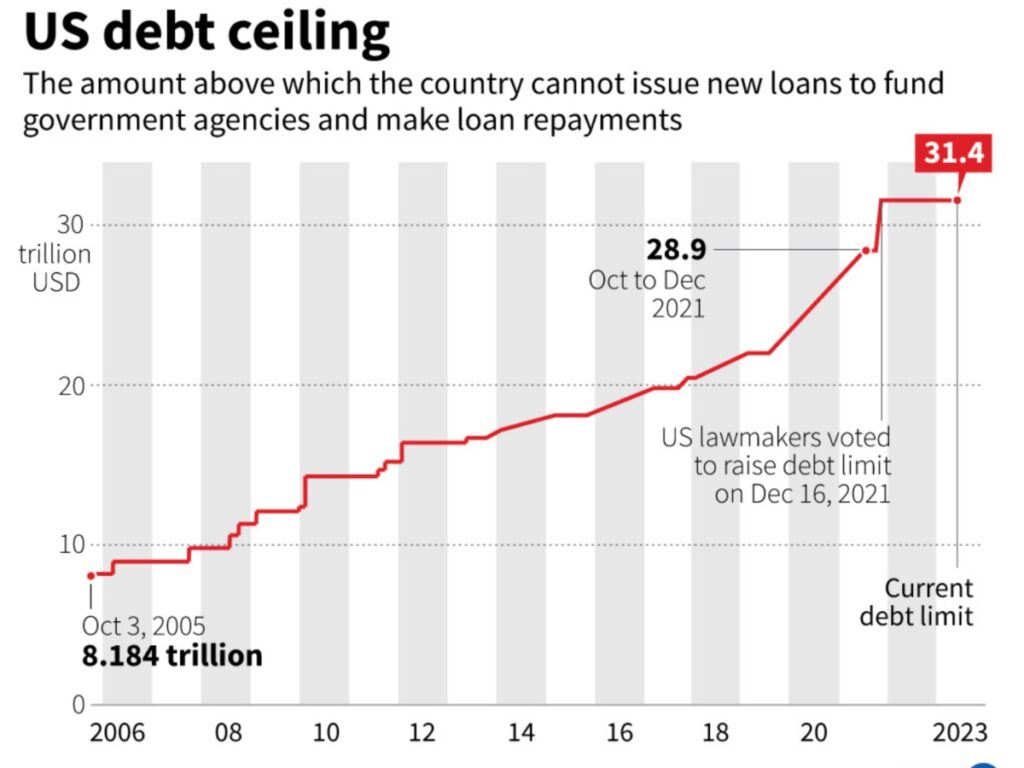

The debt ceiling is also known as the debt limit. It refers to the legislative limit implemented on the amount of national debt that the U.S. Treasury can sustain and it limits the amount that the federal government can pay for the debt it has borrowed.

The term also refers to a combined figure applicable to the gross debt, including debts available with the public and intra-government accounts. However, the debt ceiling does not cover around 0.5% of the debt.

Related: Olivia Wilde Says Her Custody Battle With Jason Sudeikis Has Put Her In “Debt”

The Emergence Of Debt Ceiling

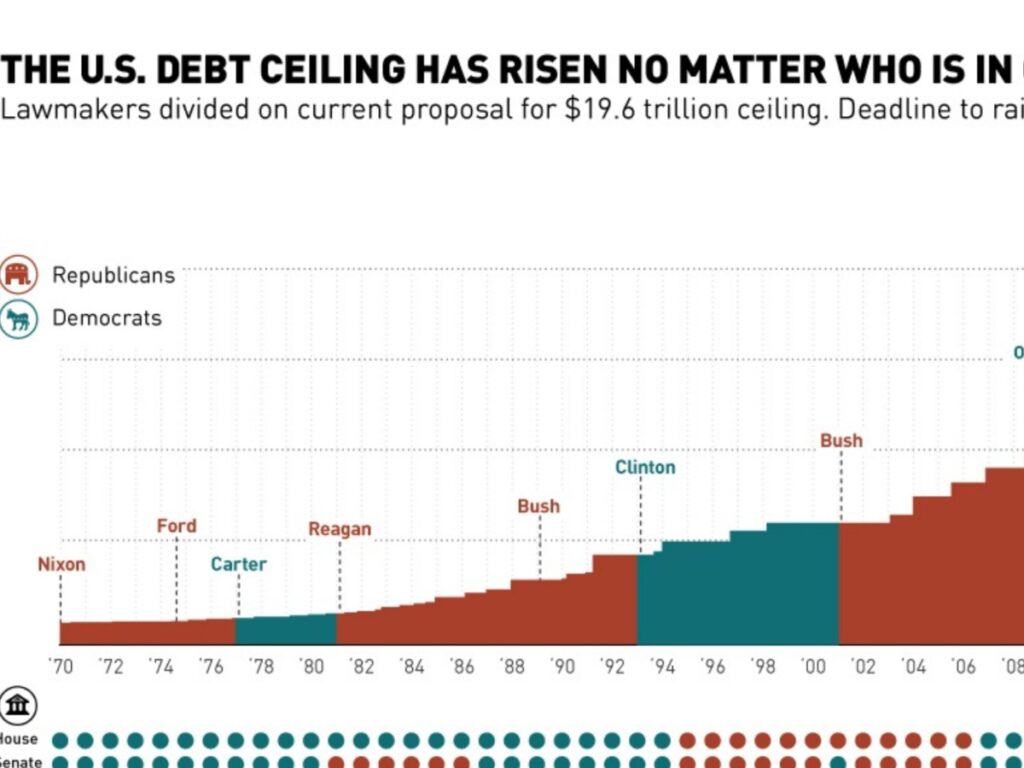

According to Article I Section 8 of the United States Constitution, Congress can approve the borrowing of money on the credit of the U.S. After the formation of the U.S. in 1917, the debts were approved by the Congress, and Congress made changes to the process for offering more flexibility in financing the involvement of the U.S. in the First World War.

The present meaning of debt ceiling refers to the total limit applicable to all federal debt which was formed by the Public Debt Acts of 1939 and 1941. The acts have also been amended to bring changes to the ceiling amount.

The debt ceiling also leads to political problems after the Treasury warns Congress that the ceiling is about to reach, indicating that a default is on the way. If the debt ceiling reaches and an increase is pending in the limit, the Treasury can decide to take some steps for getting some extra time before Congress can raise the ceiling.

In Case You Missed: “Work Was Always My Guardian Angel”: Nicolas Cage Talks Taking “Crummy” Acting Roles To Pay Financial Debts

What Can Happen If The Debt Ceiling Is Not Raised In Time?

In case the debt ceiling is not raised in time, the government has to make spending a priority and stop the progress of different programs. Selling of U.S. Treasury bonds will lead to rates becoming unstable across the board and this means more mortgage rates and borrowing costs. This can affect the financial situation of the nation.

While interest rates increase and debt holders unload the bonds, it can lead to a market panic which is the same as the stock market crash in 2008. The danger of default can also lead to a run on money market accounts.

You May Also Like To Read: